The Federal Open Market Committee (FOMC) has three scheduled meetings on the calendar for the remainder of 2024, with one wrapping up tomorrow. Each time the committee meets, it could mean a change to the federal funds rate.

A change in this rate not only impacts financial institutions but also your bottom line. With September’s meeting underway, Americans are waiting with anticipation to learn whether the Fed will finally lower its target rate.

What’s the likelihood of a rate reduction this year? Here’s what the experts think.

What is the federal funds rate, and why does it matter?

The federal funds rate is the interest rate at which depository institutions charge each other for ultra-short-term loans, usually overnight. It’s expressed as a range, and financial institutions negotiate a specific rate within that range.

The federal funds rate plays a key role in the Federal Reserve’s management of inflation. When inflation is too high, the Fed typically raises its rate to reduce consumer spending and slow economic activity. Conversely, the Fed may lower its rate to stimulate economic activity and growth.

The federal funds rate doesn’t directly affect the rates offered by individual banks, but it does have an influence. When the Fed’s target rate increases or decreases, rates for high-yield savings accounts, certificates of deposit (CDs), money market accounts, credit cards, home loans, and other banking products generally follow suit.

That means when the Fed’s rate is high, it can be a good time to deposit money in a bank account and earn more interest. When it’s low, it’s a good time to borrow money or refinance at a lower interest rate.

Read more: How do banks set their savings account interest rates?

How the federal funds rate has changed over time

Over the last year, the federal funds rate has remained unchanged. The FOMC has expressed that it will wait to make any changes until it has confidence we’re making progress toward its 2% inflation target. The Fed is meeting again on September 17-18 and will decide whether or not to adjust the federal funds rate.

Here’s a look at how rates changed in 2023 before the Fed hit pause on rate changes:

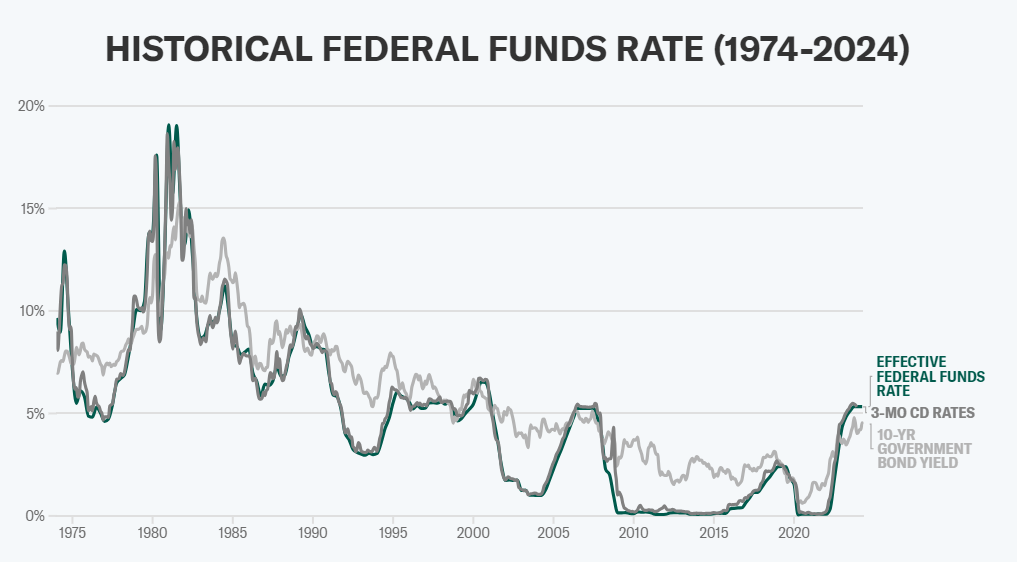

Read more: A look at the federal funds rate over the past 50 years

What’s next, according to the experts

The Fed’s job is to carefully monitor the economy and maintain stability. During each meeting, it may adjust its target rate and overall monetary policy based on what the economy needs to continue running smoothly. However, it doesn’t necessarily announce its plans ahead of time.

Economic experts monitor the economy’s health closely and formulate their own ideas about the Fed’s next move based on the data they have available. Some experts believe that this upcoming meeting could set the stage for 2024 rate cuts.

Philip Vinson, assistant professor of economics at Georgia Gwinnett College, said there are many factors that will influence the FOMC’s decision about interest rates, including inflation and the unemployment rate.

“Inflation has fallen to 2.5% as of August, which is the lowest level since February 2021. This means that the Fed has nearly, but not quite, hit their inflation target,” Vinson said.

On the other hand, the unemployment rate has remained steady at 4.2%.

“While 4.2% is still considered low, there is increasing concern that higher interest rates are jeopardizing labor markets and economic growth, so the overwhelming consensus is that Feds are about to cut rates at their September meeting,” he noted.

How big that cut will be is also a big question on the minds of Americans. According to the CME’s FedWatch Tool, the probability of a 50-basis point rate cut this week is about 65%, and the probability of a 25-basis point cut this week is about 35%.

“The consensus of market participants is that the Fed will certainly cut rates this week and it appears that 50 basis points is most likely,” said Robert R. Johnson, chairman and CEO of Economic Index Associates and a professor of finance at the Heider College of Business at Creighton University.

In fact, he believes the Fed will continue to cut rates throughout the remainder of the year. “The FedWatch tool indicates that the most likely scenario is that rates will be a full 125 basis points lower by yearend than they are today,” he explained. “In other words, market participants believe the Fed will aggressively cut rates.”

Read more: What the Fed rate decision means for bank accounts, CDs, loans, and credit cards

3 money moves you can make ahead of the next rate cut

Regardless of whether the federal funds rate changes, it’s a good time to evaluate your banking products and potentially make some savvy money moves that could pay off later.

1. Make sure you’re getting the most competitive savings account rate

Right now, the national average savings interest rate is well below 1%. But many banks and credit unions offer high-yield savings accounts with APYs as high as 5% or more — at least, for now. If your interest rate isn’t competitive, you could be leaving money on the table.

Take stock of your current deposit accounts, shop around, and see if you’re getting the best rates possible. If you’re not, it could be time to switch banks or open up a new type of account.

See our picks for the 10 best high-yield savings accounts>>

2. Lock in today’s high CD rates

One of the major perks of a CD is that it offers a fixed interest rate for the entire term. This allows you to lock in a high APY ahead of any potential rate cuts.

Keep in mind that if you make a withdrawal before your CD reaches maturity, you’ll be subject to an early withdrawal penalty. So be sure to carefully consider your savings goals before tying up your money in a CD. If you’re saving for a longer-term goal (six months to two years), opening a CD and securing a higher rate could help you reach it even faster.

See our list of the best CD rates on the market>>

3. Hold off on financing any major purchases

If you’re preparing for a big-ticket purchase (like a car or house), applying for a new loan now could potentially lock you into a higher interest rate.

It’s impossible to predict with certainty how the Fed will change rates — if at all. However, if Fed officials do decide to cut rates in the near future, lenders will likely reduce mortgage rates as well. So it could pay to hold off for a few months.