Awake-In-3D:

The Truth About the IQD and NEER – What You Need to Know

On July 13, 2023 By Awake-In-3D

Many RV/GCR Land rumor mills are leading us to believe that the NEER (Nominal Effecitve Exchange Rate) of the IQD is somehow an exchange rate crystal ball for an IQD RV. While NEER sounds esoteric and super technical, it is really quite simple to understand. Let’s get to the bottom of this, shall we?

The IQD’s NEER is not an Exchangeable Rate: It’s an Indexed Economic Measurement

Foreign currency Spot Exchange Rates refer to the rates at which one currency can be exchanged for another. These rates fluctuate based on factors like supply and demand, economic conditions, and market sentiment.

On the other hand, the NEER (Nominal Effective Exchange Rate) index rate is a measure that evaluates the value of a country’s currency against a basket of other currencies. It takes into account the trade weights of different currencies and provides a broader perspective on the overall value of a currency.

While foreign currency exchange rates focus on the specific exchange rate between two currencies, the NEER index rate provides a weighted average value of a currency against multiple currencies. NEER is more comprehensive and useful for analyzing a country’s competitiveness in international trade.

NEER vs. REER: Understanding the Differences

Before we embark on our exploration of NEER, it is crucial to grasp the difference between NEER and its counterpart, the real effective exchange rate (REER). These two terms are often intertwined, but their disparities are noteworthy.

The concept of an effective exchange rate (EER) serves as the foundation for both NEER and REER. EER represents the movement indication of a domestic currency against a complete basket of global currencies, reflecting the external competitiveness of an economy. NEER, the nominal effective exchange rate, is a weighted average that measures the competitiveness of a country’s currency in the international forex market. On the other hand, REER is the NEER adjusted for inflation differentials between the home country and its trading partners.

NEER: The Nominal Effective Exchange Rate

Let us focus our attention on NEER, the nominal effective exchange rate, and its role in economic analysis. NEER can be defined as the weighted average of a country’s currency needed to purchase foreign currencies. The weight of trading is higher for countries with whom the home country has more significant trade relations. This index measurement provides valuable insights into the relative strength or weakness of a domestic currency against global currencies. Policymakers utilize NEER for policy analysis in international trade, while forex traders employ it for currency arbitrage.

REER: What is an “Adjusted” Exchange Rate?

As we move forward, it is essential to shed light on REER, the real effective exchange rate. REER is a vital concept that forms a part of the Purchasing Power Parity hypothesis. Similar to NEER, REER reflects the strength or weakness of a currency against another currency. However, it cannot be determined in absolute terms and is calculated based on NEER. REER takes inflation differentials into account and serves as a measure to compare the worth of a nation’s currency against other nations. A REER value greater than 100 implies an overrated currency, while a value within 100 indicates an undervalued currency.

Calculating REER

To comprehend the essence of REER, we must understand the formula behind it. REER is determined by considering the average amount of bilateral exchange rates between a nation and its trading partners. This calculation is then adjusted to account for the country’s trade allocation. The resulting figure shows the relative strength or weakness of the currency in a more comprehensive manner. It provides economists and policymakers with a powerful tool to assess the economic status of a country and make informed decisions.

NEER vs. REER:

To understand the difference between NEER and REER, it is crucial to determine what each of these Indexes are measuring. NEER, being the unadjusted weighted average, might seem more straightforward at first glance. However, REER, with its inflation adjustment, provides a more accurate representation of a currency’s real value. While NEER can indicate the competitiveness of a currency in the forex market, REER offers a deeper understanding by accounting for inflation differentials. Therefore, when it comes to assessing a currency’s true strength or weakness, REER takes the lead.

IQD NEER: It is Not a “Hidden” Rate

Misconceptions in RV/GCR Land now surround NEER, leading many to believe that it is a spot exchange rate used for currency exchange. It is NOT!

However, NEER is far more complex and multifaceted than a straightforward exchange rate. It is an index measurement that encompasses a weighted average of multiple foreign currencies. NEER provides valuable insights into a country’s international competitiveness and serves as a critical tool for policymakers and forex traders alike. Understanding NEER’s true nature is essential for making informed decisions in the global economic landscape.

NEER and the Iraqi IQD Explained

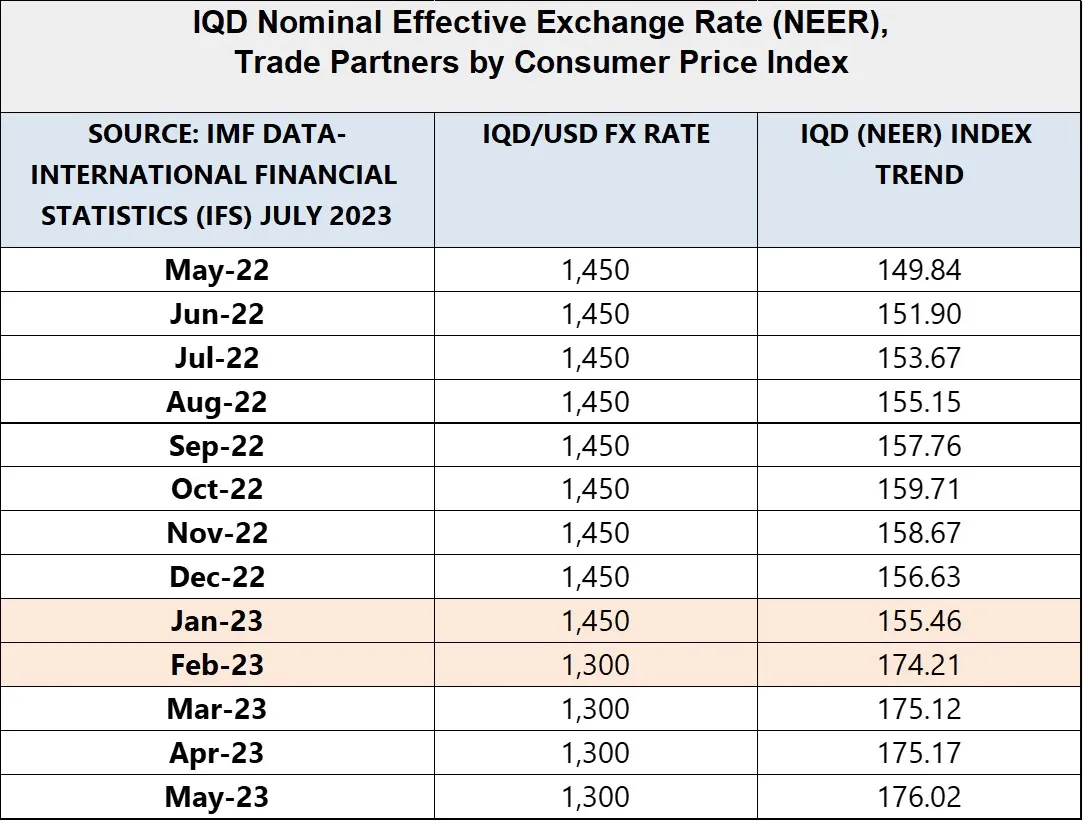

Now let’s dig into the NEER Index rate of the IQD. Contrary to popular RV/GCR Land rumor mills, the NEER index numbers for the Iraqi Dinar are not hidden and reported monthly and shown on the IMF’s Financial Data website called the IFS. The trend is moving higher as shown in the chart below.

In February/March of 2023, the Central Bank of Iraq (CBI) changed it’s fixed, nominal currency exchange rate from 1,450 to around 1,300 IQD per one US dollar which strengthened the IQD by approximately 10% against other foreign currencies. Since NEER is calculated based on Iraq’s primary Trading Partner Nations, we can see that over the past few months, the IQD appreciated by about that much, with one exception being the EURO as shown below.

Iraq’s Primary Export Trade Partner Nations and Spot Currency Exchange Rate Changes of Each

- China Trade of $10.5 Billion with CNY losing 16% against the IQD

- United Arab Emirates Trade of $5.5 Billion with AED losing 10% against the IQD

- South Korea Trade of $2.9 Billion with KRW losing 8% against the IQD

- USA Trade of $2.4 Billion with USD losing 10% against the IQD

- Japan Trade of $1.6 Billion with YEN losing 11% against the IQD

Now that you understand what NEER is based on, when you look at the above trade figures and the fact the IQD spot exchange rate strengthened from 1450 to 1300 (against the US dollar), it makes sense that NEER Index value has been increasing as shown in the charts above. The fact that the NEER rate is far above 100 indicates that the IQD is actually overvalued against its trading partner currencies.

BOTTOM LINE: The latest NEER rate of 172 for the IQD is NOT a Spot Currency Exchange Rate. It’s an INDEXED Trade-Weighted rate based on Iraq’s international trading partners amongst the partner’s basket of currencies.

You can check the NEER Index rates for the IQD here: IMF International Financial Statistics Website

Related Posts

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/the-truth-about-the-iqd-and-neer-what-you-need-to-know/