Awake-In-3D:

Japan’s Yen Crisis Grows and It’s Coming for Us

On September 17, 2023 By Awake-In-3D

In Fiat Debt System Collapse Articles

The fiat debt system financial meltdown in Japan is deepening. Japan’s Yen crisis shows us what is coming next for Europe and the United States’ fiat currencies. The Yen collapse is Event Level 10 on my soon-to-be-released RV/GCR Roadmap.

This RV/GCR Roadmap is a definitive 18 Event guide to help you navigate the steps towards the collapse of the Global Fiat Financial System and the introduction of a Financial System Reset and Revaluation scenario.

Yet we have to see the current system reach critical failure, and the Japanese Yen Crisis is a major event to watch. Here’s an update to what’s happening in Japan.

Amidst the glittering skyline of Tokyo, a financial tempest is brewing, and its name is Japan’s Yen Crisis. While it may appear as a distant storm on the horizon, its implications extend far beyond Japan’s borders, reaching the heart of the United States and the global financial landscape.

The Unfolding Events Around Japan’s Yen Crisis

n the epicenter of Tokyo’s bustling streets, Japan’s Yen Crisis looms large. Over the past year, the Japanese Yen has witnessed a precipitous collapse, plummeting by a staggering 11.5 percent against the U.S. Dollar. Japan’s efforts to stem the crisis, including selling off U.S. Dollars, have yielded little success.

What makes this crisis particularly alarming is Japan’s heavy dependence on foreign imports, especially food, fuel, and manufacturing inputs, all priced in U.S. Dollars. Consequently, as the Yen’s value continues to erode, the cost of living in Japan skyrockets.

Updating Japan’s Current Economic Situation

- The Japanese Yen has collapsed by over 11.5 percent against the U.S. Dollar in the current year.

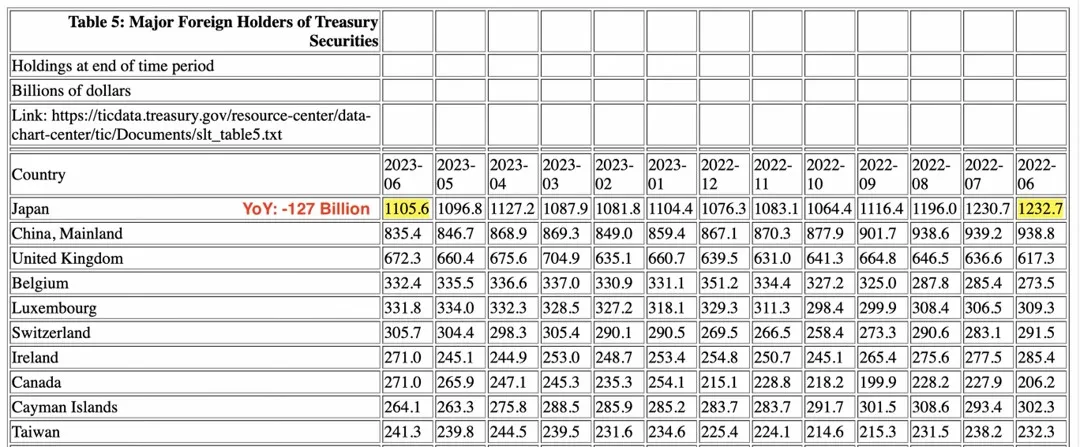

- Japan has sold over $127 billion worth of US Treasury bonds.

- Japan’s inflation rate reached 3.3 percent for June and July.

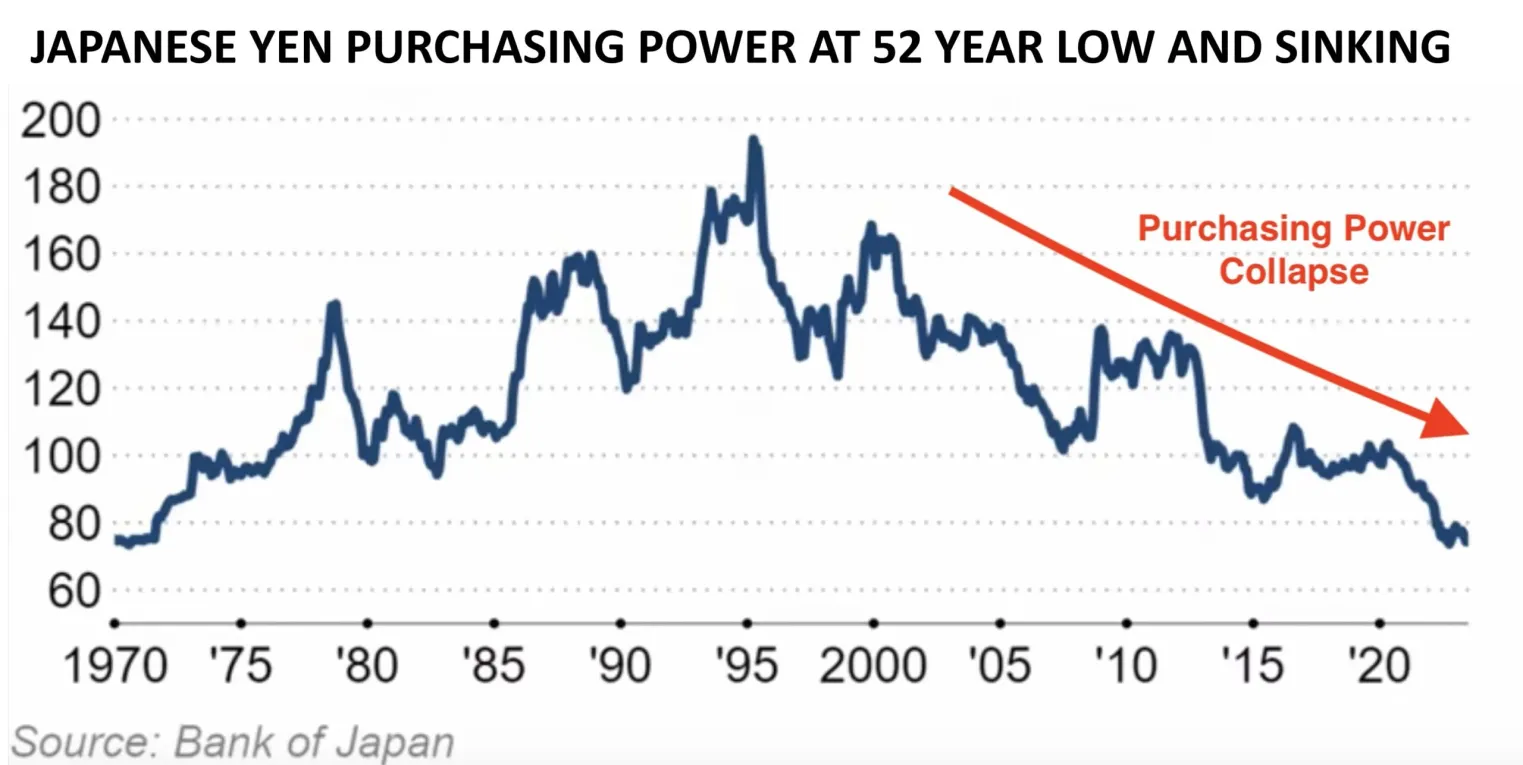

- The Yen’s buying power has dropped from its peak in 1995 back down to 1970s levels.

- Japanese real wages fell for the 16th straight month in July.

- The price of gold in Japanese Yen has appreciated by 75 percent since the lows in 2020.

- The price of gold has surged by 18 percent since January.

- U.S. inflation has gone up from 3.2 percent in July to 3.7 percent in August.

- Japan’s current Benchmark rate is still at its 2016 levels of minus 0.1 percent.

- Japanese exports fell by 0.3 percent in July.

- Japan’s pivot away from U.S. treasuries could lead to higher borrowing costs for the United States.

- A significant exodus from the U.S. bond market could occur if Japanese investors shift from U.S. treasuries to Japanese bonds.

Japan’s Yen Crisis Threatens the U.S. Treasury Market

While Japan grapples with its Yen Crisis, the U.S. Treasury market stands as one of its most significant casualties. Japan’s necessity to shed its bonds to bolster the Yen poses a grave threat. Should Japan decide to reverse its money printing strategy, the repercussions for the U.S. bond market could be dire.

This situation distinguishes itself from China’s treasury sell-off, driven more by economic imperatives than strategic motives. Japan’s actions are underscored by its astounding $127 billion in bond sales, surpassing even China’s treasury holdings.

The Bank of Japan’s Dilemma

At the heart of Japan’s Yen crisis is a strategy built on relentless money printing to stimulate its economy. The Bank of Japan (BOJ) actively purchases Japanese government bonds to suppress yields, intervening whenever they approach 0.5 percent.

Unlike the Federal Reserve, Japan appears to have no bounds to its money printing. Regrettably, the Japanese Yen bears the brunt of this approach. Goldman Sachs predicts that should the BOJ persist, the Yen could plunge by another 20 points against the U.S. Dollar, further exacerbating the plight of the Japanese populace.

The Looming U.S. Implosion Risk

Japan’s impending reversal could set off a chain reaction with profound global consequences. As Japan raises interest rates, Japanese investors may pivot from U.S. treasuries to Japanese bonds, triggering substantial currency exchange fluctuations.

This could lead to a mass exodus from the U.S. bond market, resulting in higher borrowing costs for the United States. In turn, this perfect storm might precipitate a banking crisis and a long-anticipated recession.

As Japan’s Yen Crisis continues to grow, the world watches with bated breath. The implications of this crisis extend far beyond Japan’s shores, reaching the United States and beyond.

The BOJ’s impending pivot may well be the event that reshapes the global financial landscape, making it a pivotal moment that brings us significantly closer to a Global Financial Reset and Revaluation.

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/japans-yen-crisis-grows-and-its-coming-for-us/