Critical information for the U.S. trading day

Benchmark Treasury yields are back within several basis points of their highest level in about 16 years. And stocks don’t like it. Early futures action on Thursday points to the S&P 500 recording a third day of losses in a row.

It’s a picture that strategists at Barclays, led by Ajay Rajadhyaksha, think leaves both stocks and bonds looking unattractive.

They expect weakness in U.S. economic growth in the first half of 2024 as excess savings are depleted, but this may still require the Federal Reserve to keep interest rates higher for longer relative to the market’s current expectations. Weak demand from China means many commodities may struggle too.

“[I]n environments in which investors can comfortably sit in cash yielding 5.4%, it is unreasonable to expect significant outperformance from stocks or bonds in asset allocation terms. And this thesis largely holds true,” says Barclays.

So, with the major asset classes deemed unattractive, the bank has come up with a batch of investment themes to consider for the fourth quarter of the year.

First, short the 2-year Treasury BX:TMUBMUSD02Y. Barclays reckons recent labor market data is stronger than the market thinks and that “the overall pace of job gains is still high enough to prevent the unemployment rate from rising substantially if labor force participation flat-lines.”

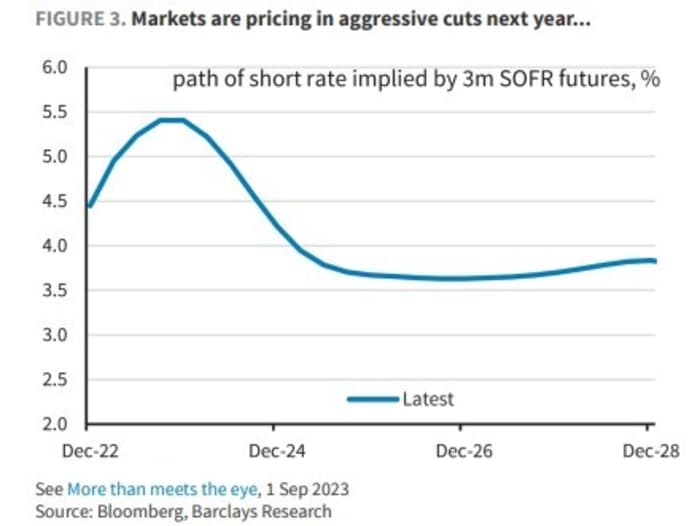

This means the overall economy will not slow sufficiently for the Fed and therefore it will likely increase interest rates to 5.5% to 5.75% by year end and cut them slower next year than traders think, with the first reduction coming as late as September 2024.

Second, the spread between U.S. and European interest rates will widen. Any U.S. economic downturn will be shallower than in Europe, so Treasury yields should be relatively higher. Furthermore, “the fiscal profile is more benign in the eurozone than in the U.S.,” and so greater issuance should also force up Treasury yields. This may make German bunds relatively more attractive.

Even though Barclays is not keen on equities, its third theme is that U.S. stocks will outperform the rest of the world. “[W]ith China flirting with deflation and Europe with stagnation, U.S. stocks (and Japan to a degree) should benefit from the ‘there is no alternative’ phenomenon,” says the bank. Also, the negative U.S earnings revision cycle has likely troughed, while those developed market more sensitive to China, such as Germany’s DAX DX:DAX, will struggle.

Next, copper will outperform iron ore. This relates to problems for China’s property sector, which Barclays believes will continue. However, iron ore has recently bounced more than 4% so far this quarter on hopes recent real-estate targeted stimuli will boost demand but copper prices have remained flat. “[This] seems inconsistent to us. A shift away from old to new infrastructure favors copper over iron ore,” says the bank.

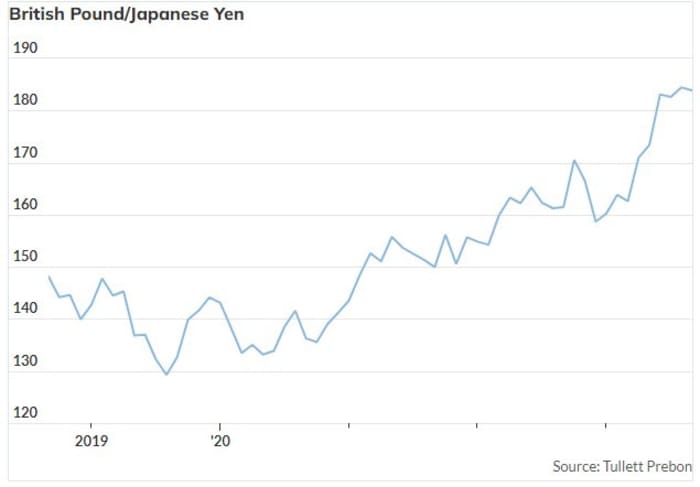

Fifth, short sterling relative to the yen GBPJPY, 0.25%. In essence, Barclays thinks the pound will struggle as the British economy falters in the face of the bank of England’s recent rate rises. In contrast the Japanese yen is due to rally due to the country’s fast-recovering current account surplus and as the over-extended carry trade (selling yen to invest in higher-yielding foreign assets) is unwound.

Finally, cyclical currencies will underperform high yielders. Slowing external and global demand in the goods sector is likely to be a headwind for growth in trade-sensitive economies. Barclays says it would therefore be short the Swedish krona USDSEK, -0.30%, New Zealand dollar USDNZD, -0.29%, Chinese yuan USDCNY, 0.21% and South Korean won USDKRW, 0.06%, and long the Hungarian forint USDHUF, -0.58%, Brazilian real USDBRL, 0.01%, Mexican peso USDMXN, -0.15% and Indian rupee USDINR, -0.34%.

Markets

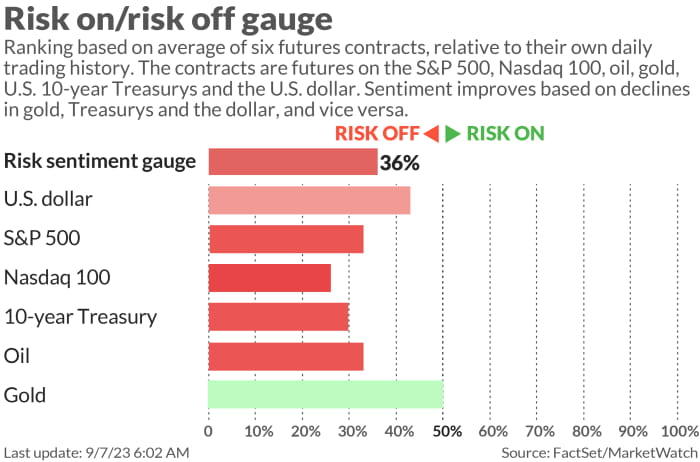

U.S. stock-index futures ES00, 0.14% YM00, 0.25% NQ00, 0.14% are mostly lower as benchmark Treasury yields BX:TMUBMUSD10Y dip a fraction. The dollar DXY is higher, while oil prices CL.1, 0.66% fall back and gold GC00, 0.01% firms.

The buzz

U.S. economic data on Thursday, include the weekly initial jobless claims report at 8:30 a.m. Eastern, alongside the revision to second quarter productivity and unit labor costs.

There is a long line of Fedspeak throughout the day. Here’s the list and times: Philadelphia Fed President Patrick Harker, 9 a.m.; Chicago Fed President Austan Goolsbee, 11:45 a.m.; New York Fed President John Williams, 3:30 p.m.; Atlanta Fed President Raphael Bostic, 3:45 p.m. and 7 p.m.; and Dallas Fed President Lorie Logan, 7.05 p.m.

China’s exports fell 8.8% in the year to August, though that was not as bad as the 10% contraction feared by some economists.

Apple AAPL, 1.24% shares are down another 2.5% in Thursday’s premarket action as reports that Beijing has banned government officials using the iPhone continue to rattle investors.

Shares of GameStop Corp. GME, -6.43% are jumping more than 6% after the videogame retailer and original meme stock reported second-quarter results that beat expectations.

But shares of C3.ai Inc. AI, 1.19% are slumping as much as 10% after the AI stalwart reported quarterly results that generally met analyst forecasts.

The chart

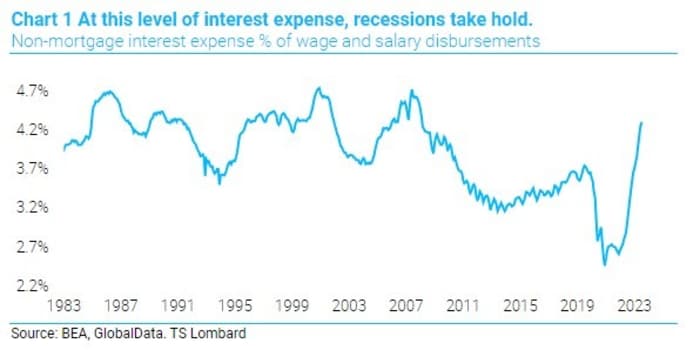

Investors betting that the U.S. consumers’ stoicism will fend off any meaningful economic contraction may like to consider a passage from the beginning of the Fed’s Beige Book of anecdotes, released Wednesday, which noted that though spending on tourism was sturdier than expected, “other retail spending continued to slow, especially on non-essential items.” It continued that in some areas “consumers may have exhausted their savings and are relying more on borrowing to support spending.”

Those observations perhaps should be read in conjunction with the chart below from Steven Blitz, chief U.S. economist at TS Lombard, who suggests it would be wrong to dismiss the impact on households of the Fed’s interest rate rises . “Interest expense as a percent of total wages and salaries has surged to levels that has kicked off recession in the past,” he notes.

https://www.marketwatch.com/story/cash-is-still-king-says-barclays-here-are-six-of-its-investment-ideas-b69ccca8?mod=home-page