The Governor of the Central Bank, Ali Al-Alaq, announced ,on Monday, that the banking sector is witnessing significant qualitative developments, while calling for cooperation and coordination between the Arab central banks, banks and non-bank financial institutions to achieve stability and economic growth.

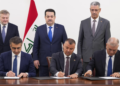

During the conference “the challenges facing Arab banks in complying with international laws and legislations and meeting the requirements of correspondent banks”, held in Baghdad in the presence of a large number of Arab Banking officials and economists, and attended by the correspondent of the Iraqi News Agency (INA ), Al-Alaq said “I am pleased to welcome you to your second country Iraq, and I extend my thanks and gratitude to the board of Directors of the Union of Arab Banks – UAB and the Secretary General of Iraqi Private Banks League – IPBL and all those who contributed to enabling the holding of this conference, Which is no secret to everyone of its importance in the framework of the many cooperation and partnerships established by the Central Bank of Iraq with various Arab and international organizations and institutions. And his openness to them in order to exchange experiences and improve performance in the banking and financial sector”.

He added that ” this reflects the compatibility of development visions and strategic goals in relation to the topics addressed, which focus on fundamental areas, such as supporting economic development, combating money laundering and terrorist financing, digitization of financial and banking services and products, electronic payments and achieving the goals of financial inclusion”, noting that “these topics directly affect the economy and the lives of citizens, as it is not possible to research the reality of the banking sector and the reality of banks away from the macroeconomics”.

Al-Alaq stressed that ” central banks faced increasing challenges after decades of traditional jobs and tasks, until each period carried different challenges that required a special approach in confronting them”, pointing out that “after long periods of low interest rates and inflation, the global economy began to face a phase characterized by high inflation and high levels of public debt and private debt, which called central banks to sense the urgent need to include financial stability and concerns about deflation within their economic models and the development of unconventional tools to deal with them”.

He added that” the financial crisis in 2008 was followed by a series of challenges, as the public debt rose and the rush to raise interest rates to face the threats of inflation, which makes servicing public debt more expensive, and here it is difficult to balance in achieving cross-cutting goals that make it difficult to approach each other “,pointing out that “since the corona crisis, it has become clear that public financial policy can fix one of the driving factors to increase inflation”.

He pointed out that” the nature of shocks and the frequency of their occurrence have changed locally and internationally, as shocks have historically occurred due to an increase in demand or a decrease, with the exception of supply shocks, which is known as the inflationary recession in the seventies of the last century ” ,pointing out that “there are many shocks today, including demand versus supply, special risks versus systemic risks, and transient versus permanent shocks, which requires a modified approach in the face of sudden and unexpected changes”.

“Central banks are facing new challenges in the interaction between financial and monetary stability, in light of the dominance of fiscal policy and the need for central banks to facilitate excessive government debt, depending on fiscal consolidation, which requires reducing spending or increasing domestic revenues, or both ,”he said.

He pointed out that “the Iraqi banking sector has witnessed great qualitative developments over the past 10 years in response to the Central Bank of Iraq’s policies and policies, where the concepts and practices of compliance, governance, risk management, precautionary control, risk-based control, Total Quality Management, business continuity, digital services and financial inclusion were introduced and applied for the first time”.

“Despite all these developments, there are still significant and mounting challenges represented by the challenges of compliance with laws, legislations, requirements and international standards” , explaining that “these challenges have a direct link and impact on the openness of local financial institutions to their international counterparts” ,he explained

He stressed that” as far as all this achieves communication and connection with the outside world, it undoubtedly carries many challenges and implications” ,expressing his hope that “this conference will succeed in satisfying it and reaching effective solutions to this challenge and devoting cooperation and coordination between Arab central banks, Arab banks and non-bank financial institutions to achieve stability and growth”.