Goldilocks’ Global Economic News 5-22-2024

“Ripple CLO Claims The SEC Has a NODE on the XRP Ledger”

A NODE offers ways to approve and process transactions without a centralized authority.

A node validates and authenticates blockchain transactions. A Blockchain node’s primary job is to confirm the legality of network transactions.

Once a confirmation is made between two digital networks through a blockchain consensus, a transaction is validated on both sides of an exchange.

A protocol brings all nodes of a distributed blockchain network into agreement on a single data set or similar data confirming the right to move forward inside a blockchain connection. Then, a digital transaction can go through for both parties.

This is done electronically and without the need of someone mediating the transaction on the QFS.

It looks like XRP and the SEC have decided to play ball together. Times Tabloid Trade Marks Ledger

© Goldilocks

~~~~~~~~~

Okay. It is official. Ripple and the SEC are doing more than playing ball together. They are in business together.

“Ripple has filed a new trademark for the phrase “RLUSD,” suggesting the likely listing symbol for its proposed dollar-based stablecoin.” Trade Mark

A trademark does three things:

* It identifies the source of your product

* It provides legal protection for your brand name and product

* It protects you against counterfeiting and fraud

This officially ties the SEC and Ripple together in a partnership. This new filing has given them intellectual property rights to copy and expand in a business together.

This love/hate relationship has certainly turned a corner. As the pages are turned on their past relationship in courts, it will certainly be interesting to read the next chapters of what they can do together. The Crypto Basic Maynardnexsen

© Goldilocks

~~~~~~~~~

Do you see why the XRP and SEC connection is so important? Yes, Ripple is ISO compliant. Now that changes things a little bit… 😉

© Goldilocks

~~~~~~~~~

ISO 20022 Crypto: Which Coins & Tokens are Compliant? – CoinCheckup

~~~~~~~~~

Iraq clears all debts to IMF | Iraqi News

Baghdad (IraqiNews.com) – The financial advisor to the Iraqi Prime Minister, Mazhar Salih, confirmed recently that Iraq has repaid all the loans it has taken from the International Monetary Fund (IMF) since 2003, a total of just under $8 billion.

Salih explained that the IMF provided several loans to Iraq, aiming to support macroeconomic stability and financial reforms, the Iraqi News Agency (INA) reported.

Between 2003 and 2021, Iraq obtained several financing programs from the IMF, including emergency loans and long-term financial assistance.

In 2016, the IMF approved a financial program worth $5.34 billion to support economic reforms in Iraq. Within five years, Iraq paid out the loan in full after obtaining two-thirds of the total.

Iraq sought a $6 billion emergency loan from the IMF in 2021; however, the loan was not granted because, at the time, it hadn’t been linked to any of the IMF’s initiatives.

Iraq’s engagement with the IMF was intended to assist in addressing the economic issues brought on by the drop in oil prices, which were connected to fluctuations in the balance of payments, as well as to promote government reforms.

~~~~~~~~~

The People’s Bank of China (PBOC) and the Bank of Thailand signed a memorandum of understanding (MOU) on Tuesday to enhance cooperation in facilitating bilateral transactions using local currencies. | Modern Diplomacy

~~~~~~~~~

The American Bankers Association urged House leaders to back a bill that would stop the Federal Reserve from creating a CBDC for individuals. | Crypto News

~~~~~~~~~

“Ripple believes in CBDCs seeing them as crucial for asset tokenization!”

Is Ripple about to be the CBDC alternative? Is Ripple quickly becoming the new CBDC? Will Ripple replace the dollar?

The answer to these questions are simply put, not likely. Yet, Ripple is what is going to move CBDCs and all assets inside the new digital economy.

Ripple respects your privacy and intends to keep your information secure. (See article below) Ripple will be the settlement token that will move your money.

This is the most likely scenario that will be seen going forward. It is an alternative option that may very well be what will take place.

Life is a Quantum Soup and the taste of the final product is and will be determined by the ingredients that make it up. Rich Turrin Substack Ripple Energy

© Goldilocks

~~~~~~~~~

👆Ripple is at the forefront of the CBDC revolution, engaging with governments globally to leverage its technology for digital currency development. In May 2023, Ripple launched a dedicated platform to assist central banks, governments, and financial institutions in issuing CBDCs and stablecoins. 2 days ago | Forbes

~~~~~~~~~

3 Unconventional Trends Reshaping The Business Landscape | Forbes

~~~~~~~~~

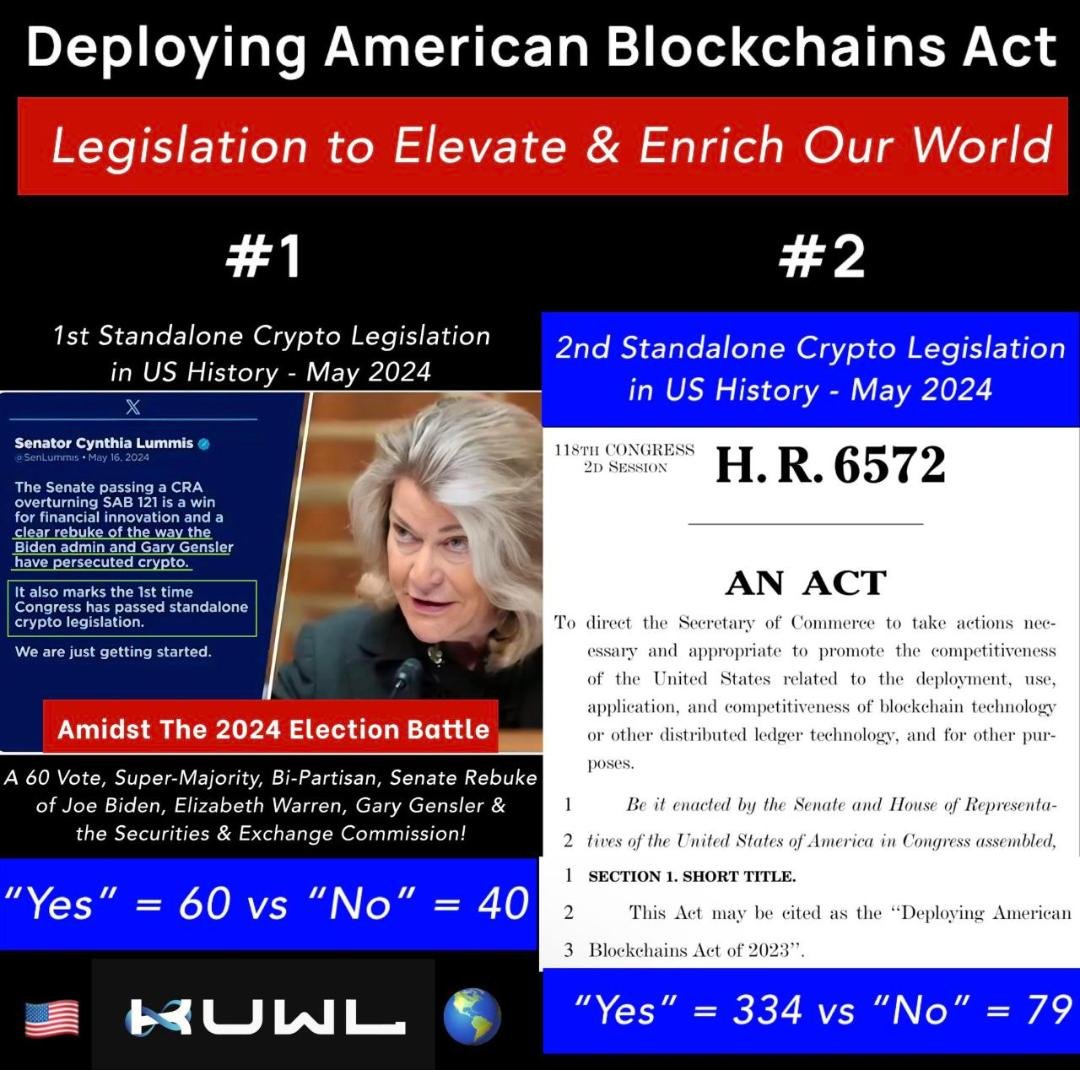

Todays House Bill removes the @SECGov entirely from crypto.

Puts all power in the hand of the Secretary of the Department of Commerce. Twitter Congress

Since 2021 this was Gina M. Raimondo. @SecRaimondo

~~~~~~~~~

Banking Announcement:

Spot Ethereum ETF approved. Ethereum is a smart contract. Here’s what it does. ETHV is currently listed on DTCC.

The DTCC is the Depository Trust & Clearing Corporation. The DTCC clears and settles virtually all broker-to-broker equity markets. Yes, Forex is an equity Market.

“A smart contract is a computer program or a transaction protocol () that is intended to automatically execute, control or document events and actions according to the terms of a contract () or an agreement.”

It ensures that both sides of a trade can be securely executed with enough funds to ensure all requirements are fulfilled. Reuters TheBlock

© Goldilocks

~~~~~~~~~

Swift Unveils New Cross-Border Payment Tracking Solution | PYMNTS

Swift Announcement:

Swift is extending ISO 20022 across the entire payment chain. 👇

“Swift has unveiled new ways for financial institutions to streamline cross-border payments for corporate customers.

The financial messaging service said it is doing this “by extending ISO 20022 across the entire payment chain and giving banks ready-to-use, white-labeled tracking services that can be activated for customers at the click of a button,” per a Tuesday (May 21) news release.

Swift plans to allow financial institutions (FIs) to capture rich data at its source by standardizing payments end-to-end with ISO 20022, according to the release.

In addition, Swift says it will also help banks offer customers payment tracking services by API or messaging channel, for complete transparency on the status of a payment as well as confirmation that it has been received.”

So now, we have access to the ISO 20022 messaging system.

* Goldilocks

~~~~~~~~~

What a month to remember…

~~~~~~~~~

Expanding the cross-boundary e-CNY | Hong Kong Monetary Authority

The Hong Kong Monetary Authority (HKMA) and the People’s Bank of China (PBoC) have made further progress in the e-CNY pilot for cross-boundary payments, to expand the scope of e-CNY pilot in Hong Kong to facilitate the setup and the use of e-CNY wallets by Hong Kong residents, as well as the top-up of e-CNY wallets through the Faster Payment System (FPS).

The interoperability between the FPS and the e-CNY system operated by the Digital Currency Institute (DCI) of the PBoC also marks the first linkage of a faster payment system with a central bank digital currency system in the world. It provides an innovative use case which underscores interoperability, a key area set out in the G20 Roadmap for enhancing cross-border payments.

~~~~~~~~~

AI Is Taking Over Accounting Jobs As People Leave The Profession | Forbes

~~~~~~~~~

Asia Pacific Outshines Globally in Instant Payments Adoption – Blockchain News

~~~~~~~~~

Swift standardizes payments end-to-end and gives banks ready-to-use tracking services to enhance corporate | Swift

👆 this is going to change ISO20222 timelines a bit…😄

~~~~~~~~~

Brussels, 21 May 2024 – Swift has today set out plans to help financial institutions streamline the cross-border payments experience for their corporate customers, by extending ISO 20022 across the entire payment chain and giving banks ready-to-use, white-labelled tracking services that can be activated for customers …1 day ago | Swift

👆 I will say more on this tomorrow. This changes the game quite a bit my friends.

~~~~~~~~~

VanEck’s Ethereum ETF listed on DTCC ahead of SEC decision | ReadWrite

VanEck’s spot Ethereum ETF listed on DTCC platform under “ETHV” ticker, awaiting SEC approval to become active.

SEC officials in contact with major exchanges to update and modify existing spot Ether ETF applications.

Crypto community divided as May 23 deadline for SEC’s decision on VanEck’s ETF application approaches.

~~~~~~~~~

A smart contract can execute an FX swap contract by locking the agreed rates and amounts on the blockchain, and transferring the funds automatically on the specified dates. This can reduce the need for intermediaries, such as banks or brokers, and lower the transaction fees and settlement time. | Linkedin

~~~~~~~~~

This Is Serious BRICS Nations Have Officially Set A Date To Ditch The US Dollar. | Twitter

~~~~~~~~~

Ripple Vs. SEC Lawsuit: Latest Filing Marks Beginning Of The End Of Historic Battle | Bitcoinist

~~~~~~~~~

IF THIS HAPPENS – CRYPTO WILL EXPLODE OVERNIGHT! MEGA CRYPTO NEWS! | Youtube

~~~~~~~~~

Secret Banking Crisis Looms; What the Fed Doesn’t Want You to Know – Insider Nomi Prins | Youtube