Insider action is closely monitored among investors. After all, it’s easy to understand why these transactions receive so much attention, as it’s a confidence booster for investors when an insider swoops in for a buy.

But who is considered an insider?

An insider is defined by Section 16 of the Security Exchange Act as an officer, director, 10% stockholder, or anyone who possesses information because of their relationship with the company. Of course, many strict rules apply.

As of late, three stocks – Lockheed Martin (LMT – Free Report) , Lennar (LEN – Free Report) , and Exxon Mobil (XOM – Free Report) – have all seen insider activity. Let’s take a closer look at each.

Exxon Mobil

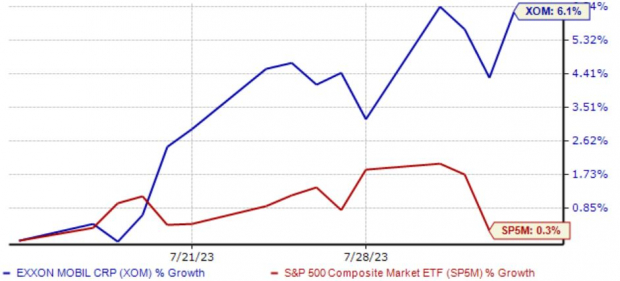

Jeffrey Ubben, a director, made a big splash very recently, acquiring 458,000 XOM shares at a total transaction value of nearly $50 million. XOM shares have found themselves back in attention following the recent rise in oil prices, up 6% since Mid-July and widely outperforming the general market.

Image Source: Zacks Investment Research

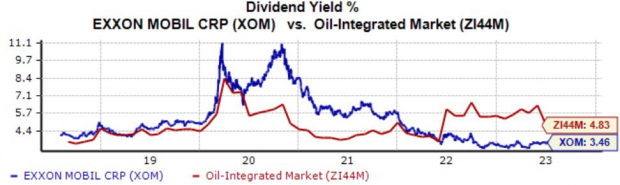

The company’s growth has significantly cooled from 2022’s euphoria, with earnings forecasted to decline 37% on 21% lower revenues in its current year. Still, income-focused investors stand to reap solid payouts, with XOM shares yielding 3.5% annually currently.

Image Source: Zacks Investment Research

In addition, the company continues to be a cash-generating machine; operating cash flow totaled $9.4 billion throughout its latest quarter, with free cash flow reaching $5 billion.

Lockheed Martin

John Donovan, a director, purchased 548 LMT shares in July, with the transaction totaling approximately $250,000. The company recently reported quarterly results, exceeding the Zacks Consensus EPS Estimate by 4.6% and sales expectations by 5%.

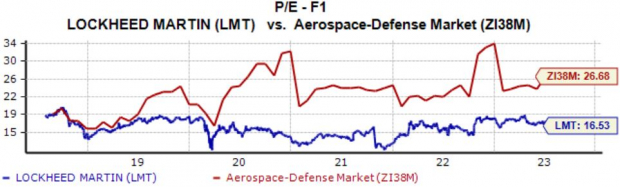

LMT shares appear attractive from a valuation standpoint, with the current 16.5X forward earnings multiple reflecting a 38% discount relative to the Zacks Aerospace – Defense industry and beneath 2022 highs of 18.4X.

The stock carries a Style Score of ‘B’ for Value.

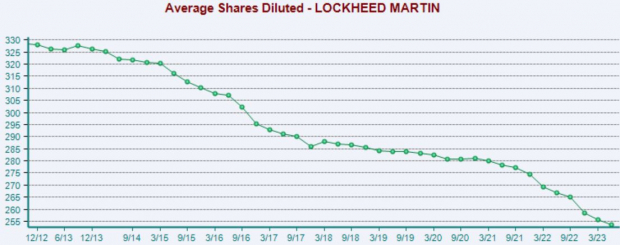

Image Source: Zacks Investment Research

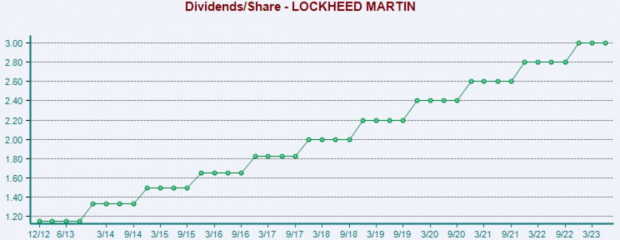

The company also boasts a shareholder-friendly nature, with its dividend payout growing more than 8% over the past five years. Shares currently yield 2.7% annually, nearly double that of its Zacks industry average.

Image Source: Zacks Investment Research

Further stating its shareholder-friendly nature, LMT purchased $500 million worth of shares and delivered $784 million in dividends throughout its latest release, with the former helping put a floor in for shares.

Image Source: Zacks Investment Research

Lennar

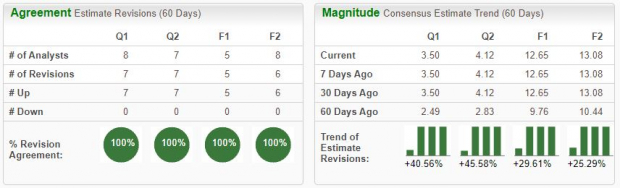

Amy Banse, a director, recently purchased roughly $100k in Lennar shares at a price tag of $126.42 per share. The company’s earnings expectations have turned highly positive over the last several months, landing the stock into the highly-coveted Zacks Rank #1 (Strong Buy).

Image Source: Zacks Investment Research

Lennar posted results that blew away expectations in its latest release, exceeding the Zacks Consensus EPS Estimate by nearly 30% and reporting sales 10% ahead of expectations. Impressively, the company has exceeded EPS expectations by an average of 20% across its last four quarters.

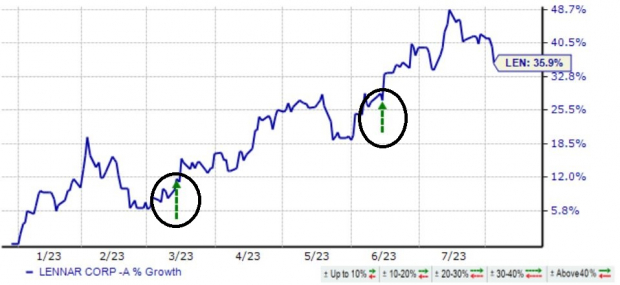

As we can see below, shares have gotten a boost post-earnings following back-to-back releases.

Image Source: Zacks Investment Research

The company’s growth is slated to taper in its current year, with estimates suggesting a 28% decline in earnings on 3% lower revenues. Still, growth resumes in FY24, as expectations allude to a 3% recovery in the bottom line and a 2.3% bump in sales year-over-year.

Bottom Line

Investors closely follow insider transactions. After all, if an insider is buying, it sends a positive message to shareholders, whereas selling could convey negative sentiment in certain circumstances.

And insiders of all three companies above – Lockheed Martin (LMT – Free Report) , Lennar (LEN – Free Report) , and Exxon Mobil (XOM – Free Report) – have recently made splashes.

Importantly, insiders have a longer-term holding horizon than most, a critical aspect that market participants should be aware of.

Zacks Names #1 Semiconductor Stock

It’s only 1/9,000th the size of NVIDIA which skyrocketed more than +800% since we recommended it. NVIDIA is still strong, but our new top chip stock has much more room to boom.

With strong earnings growth and an expanding customer base, it’s positioned to feed the rampant demand for Artificial Intelligence, Machine Learning, and Internet of Things. Global semiconductor manufacturing is projected to explode from $452 billion in 2021 to $803 billion by 2028.

https://www.zacks.com/commentary/2132209/insiders-are-diving-into-these-3-stocks?art_rec=stocks-stocks-trending_topics_popular-ID01-txt-2132209