Including Iraq… Central banks are fortifying themselves with the precious metal as a safe haven

Gold hit an all-time high of $2,940 per ounce on Thursday, pushing the market value of gold above $20 trillion for the first time ever, as trade tensions between the United States and Europe fueled fears of a global economic slowdown.

While safe haven demand is certainly one of the catalysts, another potential catalyst that could push prices even higher is a revaluation of US gold reserves.

Central banks have been on a gold-buying spree, buying more than 1,000 tonnes of the metal for the third year in a row in 2024, according to the World Gold Council (WGC).

The National Bank of Poland (NBP) led the pack, adding 90 tonnes to its reserves, while the People’s Bank of China (PBoC) announced a new purchase of 5 tonnes to start 2025, bringing its total holdings to 2,285 tonnes. Iraq was the Arab country’s biggest buyer of gold in 2024, buying 22.1 tonnes to bring its holdings to 162 tonnes.

Central banks are often considered the “smart money” in the gold market, and their continued accumulation of gold reflects a broader strategy to diversify reserves and hedge against their own policies. What’s more, this buying activity supports prices, creating a favorable backdrop for gold as an investment.

On the supply side, total gold production rose to a record 4,974 tonnes in 2024, driven by increased mine output and recycling.

Initial estimates suggest mine production has reached an all-time high of 3,661 tonnes, although final figures could see this record revised down. However, the longer-term supply outlook is less optimistic.

According to Paul Manalo of Standard & Poor’s Global, gold supply is expected to peak in 2026 before declining as new discoveries decline.

Exploration budgets have eased, rising to $7 billion in 2022, but remain above historical averages. This trend could support gold prices higher in the medium to long term, especially if demand from central banks and investors remains strong.

The high gold price environment has allowed gold mining companies to expand their operations, prioritize sustainability initiatives, and attract investor interest.

Bank of America (NYSE:BAC) estimates that companies under its coverage could generate about $3 billion in free cash flow (FCF) in the fourth quarter of 2024, with more expected this year.

Gold remains a vital diversification asset, and I believe its role as a hedge against inflation, currency depreciation and geopolitical risk remains more relevant today than ever for long-term investors.

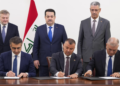

Iraq and Switzerland sign double taxation agreement to boost economic cooperation

The Ministry of Finance announced on Thursday the signing of an agreement with Switzerland to prevent double taxation and enhance economic cooperation between the two countries.

“Iraq and the Swiss Federal Union signed, on Wednesday, February 26, the initials of the agreement to prevent double taxation and evasion of payment of taxes on income and capital, in a step aimed at enhancing economic cooperation between the two countries.

The Ministry added that “the Iraqi side in the negotiations was headed by Mohammed Hamza Mustafa, Director General of the Legal Department / Acting Director General of the General Tax Authority, with the participation of a number of officials, financial and legal experts and a representative of the Iraqi Fund for Foreign Development.”

It stressed that “the agreement aims to provide an encouraging investment environment and reduce tax burdens on Swiss companies and investors, which contributes to strengthening trade and economic relations between the two countries, especially since the Swiss Federation is an advanced country in the field of tax collection and cooperation will result in attracting Swiss capital, which is considered one of the most important investments in the Middle East region, which contributes effectively to advancing the development process in Iraq.”