- Dividend season is here and companies are getting ready to pay out

- If you’re looking for last-minute dividend opportunities, look no further

- IBM, Barclays and Dorian LPG are set to issue dividends soon

As the dividend season kicks into high gear in the US, investors are actively seeking companies that are generous in sharing their profits. Let’s dive into three standout companies, each approaching their last day to buy shares eligible for dividends, which is just around the corner.

Leading the pack, we have Barclays (NYSE:BCS) and International Business Machines (NYSE:IBM), both catching the eye with their promising dividend yields. While Barclays impresses with an attractive 5.09% yield, IBM follows closely behind with a solid 4.63% yield. IBM’s long-term dividend performance is particularly noteworthy, boasting a consistent track record of rewarding investors for an impressive 27 years.

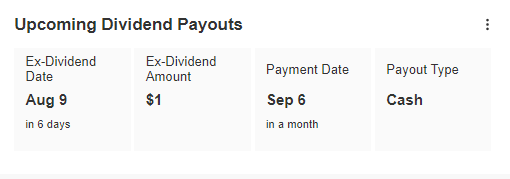

But that’s not all; another company stepping up to share its profits is Dorian LPG (NYSE:LPG), offering a remarkable $1 per share dividend, translating to an outstanding 13.54% dividend yield. With a robust dividend payout ratio of 127.92%, its commitment to investors is crystal clear.

With dividend opportunities abound, these three companies are certainly ones to watch as the clock ticks down to the last day to grab shares eligible for dividends.

Barclays: Dividends and Great Upside Potential

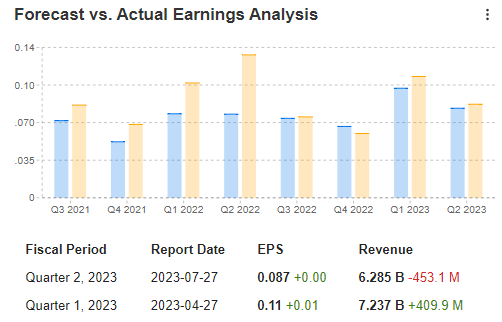

Shifting our focus to Barclays’ recent quarterly results, which were unveiled on July 27, we observed positive numbers overall. However, on the day of the announcement, the stock price dipped just over 5%.

This decline could be linked to the revision of interest margin forecasts, dropping from 3.2% to 3.15%, which suggests a possible peak. Nevertheless, Barclays remains an enticing option, especially considering its above-average fair value ratio.

Source: InvestingPro

When it comes to dividends, mark your calendars for August 10, as it’s the last day to buy shares and be eligible for the dividend payment, which stands at $2.7 per share.

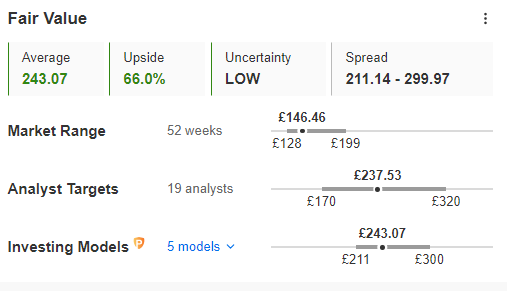

Moreover, what’s really catching attention is the remarkably high fair value index, signaling an impressive upside potential of more than 60%.

Source: InvestingPro

2. Dorian LPG: A Correction Is Likely

Dorian LPG specializes in transporting liquefied petroleum gas (LPG) using its own fleet of tankers. Recently, the demand for the company’s services has surged, particularly after sanctions were imposed on Russia, leading to a sharp increase in LPG imports from the US to Europe.

As a result, the United States has emerged as one of the leading suppliers of gas to the Old Continent, completely changing the dynamics from the previous year.

Since 2020, the company’s stock price has been following a strong upward trend, setting new historical highs in the range of $30 per share.

Recent earnings fell below market expectations, which might be signaling the beginning of a corrective movement for the company’s stock. Analysts are eyeing a potential target just below $27, where strong local support and the upward trend line converge.

For investors interested in capturing the dividend, mark August 9 on your calendar as it is the last day to buy shares and qualify for the payout. The dividend stands at an attractive $1 per share.

Source: InvestingPro

IBM: Inverted Head-And-Shoulders Formation Coming to Fruition?

Coincidentally, the ex-date (the last day to buy shares and qualify for dividends) for IBM is the same as Dorian LPG, which is August 9. IBM, the U.S. IT giant, intends to distribute earnings of $1.6 per share, resulting in the previously mentioned yield of 4.63%.

On the technical front, there’s an intriguing development to watch out for – a long-term inverted head-and-shoulders formation that has been taking shape since 2018. This pattern could potentially lead to significant market movements, making IBM a stock to keep an eye on in the coming days.

In this scenario, the crucial factor to watch is the break of the neckline situated around the $150 per share price level. Once this level is breached, it could pave the way for higher levels, with the initial target set at $175.

IBM stands to benefit from the ongoing AI and semiconductor boom, which provides long-term support for the stock. However, to return to an NVIDIA-like uptrend, the market will be looking for significantly improved quarterly results in the upcoming months.