A fierce artificial intelligence-led rally in the U.S. stock market ran out of steam in August, with the S&P 500 index on pace to suffer its worst month in six and the Nasdaq Composite set for biggest monthly decline this year, but expect September, which is just two trading days away, to be even more volatile if the past several decades are any guide.

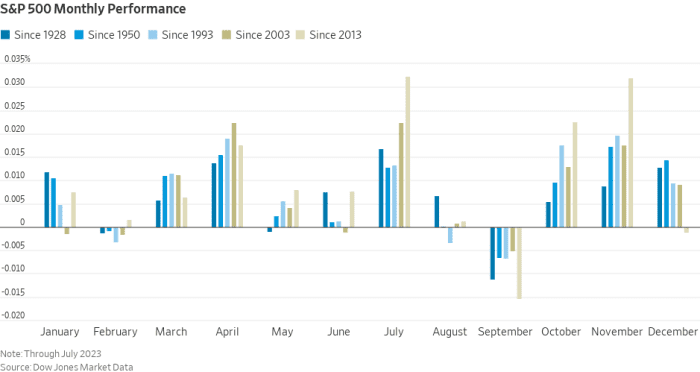

Since 1945, the large-cap S&P 500 index SPX has delivered an average monthly return of negative 0.73% in September, the worst average performance of any month, said Sam Stovall, chief investment strategist at CFRA Research. It was also the only month to see the S&P 500 suffer a monthly decline more frequently than it rose, with a “win rate” of just 44% (see chart below).

September has also seen the technology-heavy Nasdaq Composite COMP record its only negative average return since 1971. The index rallied only 52% in the same period, with an average return of negative 0.86%, according to CFRA.

“As a result of September’s track record for benchmark beatings, we remind investors to prepare for the possibility of disappointing results for both the S&P 500 and Nasdaq in the month ahead,” Stovall said in a Monday note.

SOURCE: CFRA, S&P GLOBAL

The U.S. stock market’s rapid climb this year has stalled in August after recent strong economic data has raised concern that the Federal Reserve will keep interest rates higher for longer than anticipated, which triggered a jump in longer-dated Treasury yields.

The S&P 500 has lost nearly 2% so far this month, on course for its biggest monthly decline since February. However, when the large-cap index falls 2% or more in August, the returns in September are often worse, according to Dow Jones Market Data.

SOURCE: DOW JONES MARKET DATA

The Dow Jones Industrial Average DJIA was down 1.8% and the Nasdaq Composite has dropped 2.9% month-to-date, its worst monthly decline since December, according to FactSet data.

“The stock-market volatility seen throughout August is not over and we expect continued volatility in September as the market starts to price in a slowdown in economic activity caused by the lag effect of the Fed’s past rate hikes,” said Richard Saperstein, chief investment officer at Treasury Partners.

“The stock-market pullback in August was warranted as multiples expanded rapidly and yields on the 10-year Treasury surged, suggesting inflation and rates will remain higher for longer,” Saperstein said.

However, Mark Newton, head of technical strategy at Fundstrat Global Advisors, said September might not prove to be as negative as many investors have expected.

In pre-election years since 1935, the first half of September tends to be “much better” than the second half. Meanwhile, while the median return is negative 0.04% for September in pre-election years, the average return has been positive since 1935, with returns of 0.2%, according to Newton, citing Fundstrat and Bloomberg’s data.

However, Newton thinks a negative stock-market return in September is “less likely” to happen this year as various technical signs that have begun to suggest a stock-market rally should get underway.

First, stock-market sentiment has retreated sharply in the last few weeks from bullish levels in late July, which “should provide a cushion on equity weakness into early September.” The weekly AAII Investor Sentiment Survey shows bullish sentiment decreased and is below average for the second consecutive week in the seven days to last Wednesday.

An overly bullish sentiment may cause some investors to take a contrarian view, because when everyone else in the stock market is most optimistic, it is often a good time to sell. If the survey indicates a high level of bearish market sentiment, contrarian investors will expect a market uptrend.

Moreover, the intermediate-term peaks on the U.S. dollar and U.S. Treasury yields are near, despite a possible push back to new highs in yield into early September, said Newton.

The ICE U.S. Dollar Index DXY, a gauge of the dollar’s strength against a batch of major currencies, Friday traded at its highest level since June 7, before moving lower, at 103.09 on Wednesday morning.

The 10-year Treasury note yield BX:TMUBMUSD10Y rose to its highest level at 4.339% since November 2007 last week, but the rate retreated to 4.107% on Wednesday morning, according to FactSet.

“Overall, many of the bullish factors suggest that a low [in stock market] is right around the corner and markets might be able to experience gains in the first half of September,” said Newton.

U.S. stock indexes traded modestly higher on Wednesday with the S&P 500 rising 0.4%, to 4,516, while the Dow industrials gained 0.2% and the Nasdaq Composite advanced 0.6%, at 14,026.

https://www.marketwatch.com/story/what-history-says-about-stock-market-in-september-after-ai-driven-rally-screeches-to-a-halt-in-august-bfae8f62?mod=home-page