Awake-In-3D:

RV/GCR Financial News Roundup for this Week

On October 9, 2023 By Awake-In-3D

Highlights this week as we witness the logical conclusion to the global fiat currency debt system leading to Our GCR and RV.

Foreigners hold approximately $18 trillion worth of US assets, of which $7.5 trillion are US Treasury securities.

As the US debt continues to rise and reach $33 trillion, the attractiveness of these IOUs as part of the fiat currency debt system is diminishing.

This highlights the urgent need for a Global Currency Reset (GCR) and the revaluation (RV) of currencies backed by tangible assets.

The median monthly home payment in the US has soared to an all-time high of $2,839, with a significant increase over the past 10 years.

This rise is a direct consequence of the debt-based fiat currency system, which has led to inflation and reduced purchasing power.

The need for a GCR and RV becomes even more evident as the median home payment has become unaffordable for many, reaching unsustainable levels.

The US economy’s proximity to a recession is a clear indication of the inherent flaws in the fiat currency debt system.

The steepening yield curve, historically associated with economic downturns, further emphasizes the urgent need for a GCR and RV to address the structural issues and imbalances within the current financial system.

The US national debt surpassing $33.5 trillion, with a rapid increase in just a few weeks, reveals the fragility of the fiat currency debt system.

Despite optimistic GDP growth forecasts and job creation, the growing debt highlights the underlying weakness and unsustainability of the current system. A GCR and RV would offer an opportunity to reset the financial system and address the unsustainable debt levels.

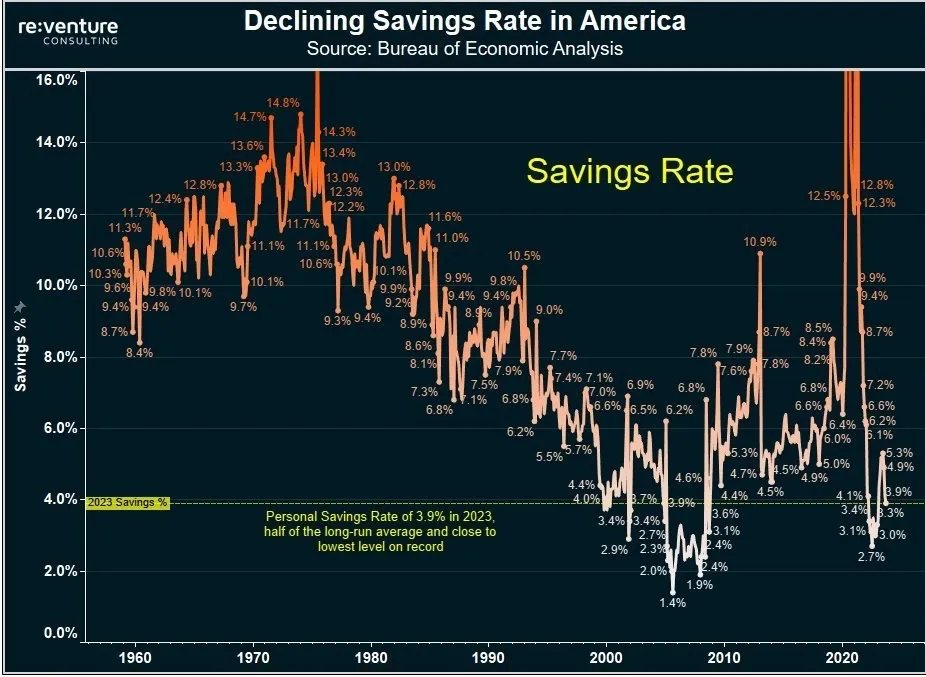

Chart of the Week

Personal savings rates in the US are down to 3.9% which is HALF of the long-run average.

This is also just above the 2008 low of 1.4% which marks the lowest level on record.

Key Financial Events This Week:

-

Wednesday – September PPI Inflation: This data will further highlight the inflationary pressures and the need for a GCR and RV to address the root causes of inflation within the fiat currency system.

-

Wednesday – Release of Fed Meeting Minutes: The Federal Reserve’s discussions and actions play a crucial role in shaping the financial system. Any insights into their considerations will be important for understanding the potential for a GCR and RV.

-

Thursday – September CPI Inflation: This data will provide additional insights into inflation trends and reinforce the need for a GCR and RV to restore stability and mitigate the adverse effects of inflation.

-

Thursday – OPEC Monthly Report: Monitoring OPEC’s report is vital as it impacts global oil prices, which are closely linked to currency valuations. The potential for a GCR and RV could have implications for oil-dependent economies.

-

Thursday – Jobless Claims Data: Tracking jobless claims is crucial for assessing the overall health of the economy and its impact on the need for a GCR and RV to stimulate growth and address unemployment.

-

A total of 12 Fed speaker events scheduled: These events provide an opportunity to understand the perspectives of influential individuals within the financial system. Their insights may shed light on the potential for a GCR and RV and the necessary steps to transition away from the current debt-based fiat currency system.

These news updates and key events reinforce the growing need for a Global Currency Reset and the revaluation of currencies backed by tangible assets as a solution to the inherent flaws and growing unsustainability of the current fiat currency debt system.

My primary belief is that the Global Fiat Currency Debt System must come to its logical conclusion before Our GCR will be introduced – which includes the release of the “General Redemptions” funding for RV/GCR exchanges.

But how do you track the connected events and progress of the logical conclusion of the Fiat Financial System?

It’s easy when you follow my unique RV/GCR Roadmap right here at GCR Real-Time News

© Awake-In-3D | GCR Real-Time News

Ai3D Website: Ai3D.blog

Ai3D on Telegram: GCR_RealTimeNews

Ai3D on Twitter: @Real_AwakeIn3D

https://ai3d.blog/rv-gcr-financial-news-roundup-for-this-week/